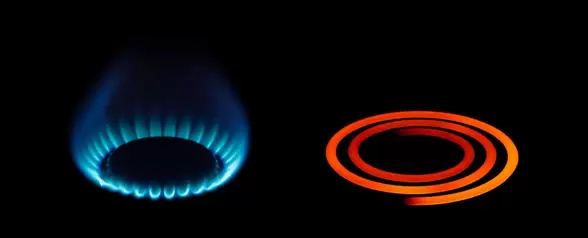

Why October is one of the best times to switch energy supplier (if you pay by direct debit)

Save £££ on your energy bills |

|

It’s always a good time to switch and save on your energy – and the sooner you do it, the sooner you can stack up savings.

That said, if you were to make the switch from a pricey Standard Variable Tariff now (before colder temperatures arrive and usage goes up) you might find a bonus benefit. That’s because of the concept of energy credit (which hits its peak at the end of summer). BE PREPARED. SWITCH BEFORE THE COLD WEATHER HITS |

|

|

Could switching energy suppliers now give you an extra boost?

There are a few things to consider – the most important being that this sort of credit may only apply to you if you pay by direct debit. The reason is that if you pay via direct debit, you probably pay a fixed amount each month. But of course, you don’t use the exact same amount of energy each month. So suppliers estimate your usage over the course of the year, using things like the size of your home and past usage. They average it out over 12 months, which is the amount of your direct debit. For example: Let’s imagine you pay £100 per month for energy by direct debit. The imaginary “you” consumes £80 worth of energy in the warmest six months of the year. However, in the coldest six months, consumption goes up to £120 worth of energy. *Energy use in warmer months: £80 x 6 months = £480 *Energy use in colder months: £120 x 6 months = £720 *How it balances out: £480 (warmer months) + £720 (colder months) = £1200 of usage *A fixed £100 per month x 12 months in a year = £1200 of payments So it balances out, making the monthly cost something you can anticipate. And it’s that extra amount you pay in warmer months that gives you the credit. Remember how in the warmer months, pretend “you” only used £480 worth of energy? But that is not what you paid. Instead, you paid £100 a month on your bill (£600 total). That’s what gives “you” the credit – £120 of surplus in your account. DON'T LEAVE IT TOO LATE. SWITCH NOW AND SAVE And here’s where that credit can turn into extra cash. If the imaginary “you” then switched to a lower tariff – especially from an expensive Standard Variable Tariff to a bargain tariff, you could potentially save hundreds, regardless of any credit. That’s amazing on its own – but even better is if that theoretical extra £120 from overpaying in summer was credited back after you left your old supplier. It’s important to note that you’d restart the cycle of credit/debit on the new tariff. This means you could go into debit in the colder months; however this would in theory be balanced out by paying a bit more when summer rolled around again, which leads to you breaking even in theory. |

|

|

Join our Collective and save money

Switching in October may come along with a bonus beyond credit. Due to collective bargaining power, the more people who register the better the deal will be, so get your friends and family to register too. If you’re interested in taking it up, it’s quick and easy to switch and you will lock in savings for at least a year. Then if you have credit, this is the time to grab it. After the switching process is finished, you can get in touch with your old supplier and request that any account credit be issued to you. |

|

You could save up to £497 on your energy bills! |