|

CLICK HERE: Paula Keeting, a retired nurse from Bournemouth, saved over £500 on her family’s car insurance | GET YOUR CHEAPEST CAR INSURANCE QUOTE NOW The crash for cash scam has increased at an alarming rate in recent times. There has been an investigation by the Insurance Fraud Bureau (IFB) which suggests an astonishing 170,000 car insurance claims in the last 15 months were linked to crash for cash gangs. The IFB has highlighted which areas in particular are bad for this scam and they include B25, B34 and B8 of postcode areas of Birmingham and the BD7 and BD3 parts of Bradford. Innocent drivers can be caught up in these collisions giving them a traumatic experience and even have a negative physical health impact. The innocent drivers will also have their own insurance premiums affected, losing their no claims bonus and having to pay excess for any damage caused. The Association of British Insurers (ABI) said "These criminal gangs are often highly organised and put lives at risk. The amounts that they fraudulently claim can be huge, and can impact on the motor premiums paid by honest motorists.” CLICK HERE: Alwyn Williams saved £342 on his car insurance | GET A QUOTE NOW By pinpointing hotspots the IFB has hoped that drivers will be more vigilant when in these areas where it is known that the criminal gangs operate. There have been cases of huge convictions for these scam operators. One such example was back in 2018 where a group of scammers involved in bogus insurance claims were convicted of conspiracy to defraud. The full scale of these crimes which were conducted in Wales involved over 150 people and cost companies over £2 million in false claims.

With these criminals pushing up prices of insurance premiums for those on the road who are innocent it is even more important to try and save yourself money. Shopping around on A Spokesman Said will help you get the deal that’s best for you. Saving money and making sure you’re covered properly to protect against scammers is essential. Please help yourself and compare here on A Spokesman Said. CLICK HERE: Jim, a radio presenter from Glasgow saved a whopping £600 on his car insurance | GET A QUOTE NOW

0 Comments

The government has introduced a traffic light system for deciding which countries brits are able to visit after 17th May when lockdown restrictions ease. Holidaymakers going to green light destinations do not have quarantine on their return to the UK but must have a negative Covid test two days prior to their return. Amber light means a 10 day at home quarantine upon return as well as Covid tests both before travelling and before returning. Amber travel destinations should not be for leisure purposes. Finally, red light means a 10 day quarantine in a government managed hotel which will cost £1,175 per person. Again the same as amber you might have a test before leaving and before coming back whilst also not travelling to a red location for leisure purposes. CLICK HERE: Compare travel insurance with A Spokesman Said and save £££ You will remember last year there was a large amount of disruption for holidaymakers when they raced to get home and cut their holidays short to avoid quarantine and changing Covid rules. The government is planning to reduce disruption this year by moving countries between the different colours in the traffic light system every 3 weeks. This compares to last year where rules were changing weekly, however the government has not ruled out disruption completely saying it “will not hesitate to act immediately should data show countries’ risk ratings have changed.” As well as the risk of disruption from travelling you must factor in the costs of Covid tests when travelling as they are even required when coming from a green light country. Prices of Covid tests are slowly on the way down but as an example a government approved test provider will cost £58. There are alternatives to this however that will be slightly cheaper.

CLICK HERE: Compare travel insurance with A Spokesman Said and save £££ Currently the only usual British tourist destination on the green light list is Portugal. Holidaymakers can flock to the Algarve without the need to quarantine and I’m sure they will go there in great numbers. Australia and New Zealand are also on the green list but those countries are not accepting international visitors at the moment. The amber list countries such as France, Spain and Italy are typical holiday destinations and it is still feasible to visit these countries as you can quarantine at home for 10 days afterwards, with many of us working from home during Covid it makes it easier to quarantine at home without too much life disruption. Countries on the red list should be missed out completely and these include Turkey, South Africa and India. This is great news that travel is on the agenda this summer. Please make sure you are properly insured for your holiday though. Here at A Spokesman Said we can find the best and cheapest travel insurance deal for you. CLICK HERE: Compare travel insurance with A Spokesman Said and save £££ Vauxhall revealed as the make of car most likely to be involved in a road traffic accident5/10/2021 New data from the Department of Transport reveals which makes of cars are in the most accidents on the road. Vauxhall make up 3 of the top 5 models of car to have the most accidents per 10,000 cars on the road. The Vauxhall Zafira astonishingly had 511 accidents per 10,000 models on the road. There are a few reasons why Vauxhall might have come out on top like the fact that they are generally cheaper cars so bought by younger people who may be less experienced drivers and involved in more road accidents. CLICK HERE: Save ££££ on your car insurance | GET A QUOTE NOW Audi has been revealed as the safest car make on the road. This is despite only 4 other manufacturers having more cars on the road than Audi they still post the least amount of accidents per 10,000 models. The luxury models such as Ferrari and Aston Martin were amongst the safest pout there also. This you would imagine is down to the profile of the owner of these makes and the fact that not many of these luxury cars are out there on the road. Vauxhall are not the only high risk car when it comes to accidents they were swiftly followed on the list by competitors Renault, Peugeot and Ford. These companies all tend to make similarly cheaper cars so it makes sense for them to be together when it comes to accidents on the road.

CLICK HERE: Save ££££ on your car insurance | GET A QUOTE NOW The most important thing is to drive safely, this is ultimately what will dictate whether you have accidents on the road not the make of the car. If you are unfortunate enough to be involved in a traffic collision then please do make sure you are insured properly. Here at A Spokesman Said we are out to find the best and cheapest cover for you. So make sure you should around through our website and save money whilst being covered. The Director General of the BBC Tim Davie has said the rules for external interests should be clearer. There are many BBC presenters moonlighting and making thousands of pounds on top of their hefty BBC salaries. The BBC has published its first moonlight register from January to March and shows presenters that have earned £5,000 or more per engagement. These include Dan Walker, Emily Maitlis, Justin Webb and Louise Minchin among others. CLICK HERE: Save ££££ on your bills with A Spokesman Said| Compare & Save Now These presenters are only in demand from external companies due to their BBC jobs. They are using their position working for the public broadcaster for financial gain. A BBC spokesperson said “The BBC’s robust and longstanding Editorial Guidelines permit staff to carry out additional engagements as long as they do not compromise the integrity or impartiality of the BBC.” I would argue that some of these jobs are breaking the integrity and impartiality of the BBC. For example Jon Sopel the North America editor spoke for both tobacco company Phillip Morris International and JP Morgan, clearly speaking for companies with agendas such as these it brings the impartiality of the BBC into question.

CLICK HERE: Save ££££ on your bills with A Spokesman Said| Compare & Save Now We the license fee payers are giving these presenters their salaries. We are paying a presenter such as Justin Webb £250,000 a year for a 4 day week on Radio 4 which he then topped up with £20,000 from outside engagements. I would suggest he gives this money back to subsidise his wage that we pay for. People should be looking to cancel their license fee and not give money to the overpaid on screen talent at the BBC, talent which is not satisfied by the enormous salaries they already receive but seek to supplement wages speaking for companies which break impartiality and integrity rules. Carole Patterson worked hard to get on the property ladder 10 years ago when buying a £170,000 one bedroom flat in South London. With todays difficulties in gaining a foothold on the property ladder this is commendable. She has however been duped by the leasehold contract she signed which requires her to pay an annual ground rent bill which astonishingly will eventually end up at more that £1 million annually. She currently pays £1,050 per year and that fee will double every 5 years. You could be paying under £142 for home insurance | Compare and Save She claims that her lawyer was negligent in pointing out the outrageous fees in her contract. There are three other flats in the building and none of them pay a ground rent charge, possibly due to the lawyers having wisely asked for it to be removed from the contract. This story is a disgrace as Carole Patterson paid her lawyers to look out for her best interests when buying the property in the first place and what did they do? They did the one thing lawyers know how to do and thats take the cheque. The government launched an investigation into spiralling ground rents back in 2017 and there was a plan introduce zero ground rent for a period of 990 years. This is still to be debated in parliament and may even be pushed back until 2022. No good for decent hard working people like Carole Patterson who have essentially been tricked into these horrendous contracts. FCB Mandy Bowdler were Carole’s legal team when buying this property and she is now taking legal action against them. I hope she wins taking on these cowboys and it encourages others to do the same against the money grabbing lawyers.

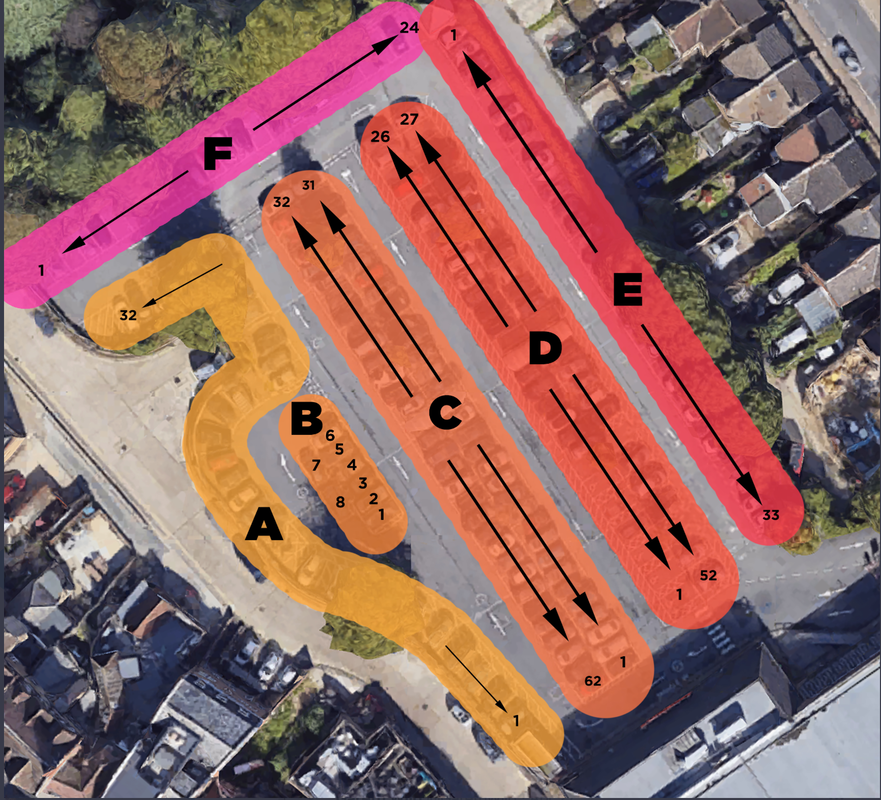

Man completes quest to park in all 211 Bromley Sainsbury's parking bays over a six year period4/29/2021 A man has completed a mission of parking in all 211 bays of his local Sainsbury’s in Bromley, south east London. Gareth Wild has spent six years trying to achieve his goal to park himself in every space and has logged them all in a chart ranking the best to worst. Mr Wild took to his Twitter account to share his findings with his 5,000 followers and was surprised to see how popular the tweet became, with over 123,000 likes he has gone viral. CLICK HERE: Save ££££ on your bills with A Spokesman Said| Compare & Save Now The dad of two even split the car park into different sections saying “I also assigned different zones – the more I say it the more stupid it sounds – to each of the areas so each time I went it was easier for me to know which ones I still had to tick off, rather than a scatter gun approach.” Efficiency was key for this job. Gareth Wild said "I find enjoyment in the little banal things in life.” So it seems does the twitter community who have enjoyed Mr Wild’s thread on the subject. When asked what possessed him to take on the challenge in the first place he said "I do the weekly shop in our family and I've been going to the same Sainsbury's for the last 16 years. It was only six years ago when I said to myself, 'wow I could probably park in every single one of these spaces given enough time', and time is on your side when you're doing the weekly shop.” Well Gareth we are very much glad you did take the time for this task.

CLICK HERE: Households that compare gas and electricity tariffs could save £350 a year | COMPARE ENERGY QUOTES NOW Great news as transport secretary says the chances of a holiday abroad this summer "look good"4/28/2021 There’s at last some good news for Britons today. Transport secretary Grant Shapps has said that the chances of a foreign holiday “look good” this summer. The existing NHS app which is used to book appointments and organise prescriptions will be used as a vaccine passport as it will display evidence that someone has received their vaccine. CLICK HERE: Compare the cheapest travel insurance deals with A Spokesman Said Most European holiday destinations have announced that they will open themselves up to British holidaymakers. They will however require confirmation that the tourist has received a vaccine or in some cases provided a negative test result. The confirmation today that the NHS app will be used is a big step towards that and will allow people to comply with the rules of whichever country they visit. In relation to summer holidays Shapps told Sky News “I have to say that so far the data does continue to look good from a UK perspective, notwithstanding those concerns about where people might be travelling to and making sure we’re protected from the disease being reimported.” This is great to hear for those who would rather travel abroad than engage in the over priced staycations being offered this summer.

CLICK HERE: Compare the cheapest travel insurance deals with A Spokesman Said With the lockdown coming to an end and summer holidays on the horizon you should start looking at travel insurance options. Here at A Spokesman Said we have got you covered. Make sure you are fully covered and save as much money as possible by comparing through us. As Nicola Sturgeon campaigns for her party to win the Scottish elections on the 6th May she tells the voters of how brilliant independence will be for them. She however neglects the hard facts of how terrible financially that independence would be for the Scots. A report by the Institute for Government (IfG) has found that Britons living in Scotland each benefit from £2,500 extra in public spending than the taxes they pay. The English though receive just £91. CLICK HERE: Save up to £497 on your energy bills | GET QUOTES NOW What Sturgeon won’t admit is that in fact Scotland will be far worse off economically after independence. Taxes will rocket to pay for the welfare state that the SNP have cultivated and the quality of public services will go down without the English paying for it. If there is appetite for Scotland to leave the UK from the people then maybe we should wave them a fond farewell. We will be better off for not sending our money up there. Between 2018-19 just 0.3% of Englands GDP was deficit compared to almost 7.7% in Scotland. The SNP Finance Secretary Kate Forbes said “Scotland is a wealthy country and with our abundant resources combined with the economic powers of independence, there is no reason whatsoever we cannot emulate the success of independent countries like Denmark and Norway which are richer per head than the UK.” Are these abundant resources she talks of the increasingly failing oil market?

CLICK HERE: Save ££££ on your bills with A Spokesman Said| Compare & Save Now The chief economist at the IfG Gemma Tetlow said “Any advocates for breaking away from the UK must address the reality of the nations' current fiscal imbalances and the difficult policy choices these would necessitate after secession.The larger the deficit that they have, the harder the case for breaking away from the union becomes.” Where is Nicola Sturgeons answer to how she will keep up the spending spree? I think Boris would happily let her and Scotland leave the union whilst we try and recoup some of the money lost during Covid. At A Spokesman Said we regularly receive reviews and complaints about various companies. One that has come up on the radar recently is Pockit, they are a financial technology company who offer pre-paid spending cards and current accounts. Pockit is designed for low income customers who are unbanked. They claim to serve those who are neglected by high street banks and help them build up their credit. CLICK HERE: You could save £££ on your household bills | Search A Spokesman Said for the best deals We have received a number of alarming complaints regarding Pockit and their customer service. A complaint we regularly get is that Pockit are freezing accounts and not giving any explanation to customers as to why they have done this. For example one A Spokesman Said user Viktor Kazakov complained that “Pockit froze my account for money laundering and fraud prevention review. I provided all documents and explanations that I was asked for. Pockit stopped asking me questions and answering my emails. They refused to give a deadline for completion of their review. I am now convinced that this business was set up to defraud customers under the pretext of fighting fraud. If anyone has any experience with getting their money back from these scammers please share. I am now preparing a complaint to the Financial Ombudsman Service.” Pockit have not yet responded to this complaint or resolved it. They have an average of 1/5 stars on the A Spokesman Said review section putting them as one of the post complained about companies on our platform. Pocket have raised over £27 million in funding since their inception in 2014 but what seems a good idea in practice to give those with low credit an option for banking has turned into a customer service nightmare.

CLICK HERE: Save up to £497 on your energy bills | GET QUOTES NOW We at A Spokesman Said hope that Pockit will respond to the complaints made on our website and will rectify these issues with customers. If you have a complaint about Pockit or any other company please do come to A Spokesman Said and we will try to fight your corner. Click here to write and submit your own review. The latest Prince Andrew scandal as he goes into business with a banker accused of sexual harassment4/27/2021 It’s hard to keep up with Prince Andrew’s blunders. The latest scandal to surround the Duke of York is that he has gone into business with a former Coutts banker who left his post after allegations of sexual harassment. It really makes you wonder about the mind behind the duke. He had managed to keep himself quiet over the period of the last year leaving any royal gossip to his nephew who has exploited his royal status for fame and an LA life. Andrew however had recently come back into the fold due to his fathers funeral and reports that he wanted to dress in a full admirals uniform for the service, this was quickly quashed by The Queen. CLICK HERE: SAVE YOURSELF MONEY AND COMPARE BROADBAND DEALS NOW Andrew has set up this company with banker Harry Keogh who was said to be so toxic at Coutts that some female colleagues would refuse to work with him. He was also accused of touching a woman groin before leaving his post there. The company is called Lincelles and will manage his family money. A source close to Andrew said in regards to the allegations against Keogh that they “don’t appear to have been subject to any investigation by law enforcement or independent third parties and nor have they been tested by due process in a court of law”. Does this seem like the sort of man Prince Andrew should be going into business with? We already know the questions around his alleged links to the now dead convicted sex offender Jeffrey Epstein. Andrew is managing to embarrass the royal family beyond all measure, particularly awful in a time of the mourning of Prince Phillip who was a great example of the good side of the royal family. Andrew is an example of the bad side, a man who’s arrogance knows no bounds and who just moves from disaster to disaster. The British people do not want to hear from him in public life again.

CLICK HERE: Save ££££ on your car insurance | GET A QUOTE NOW Post Office chief executive walked away with £4.9million whilst 39 employees were wrongly convicted4/26/2021 The former Post Office chief executive Paula Vennells who was responsible for the suffering of 39 wrongly convicted Post Office workers has now resigned from her other posts at Dunelm and Morrisons in the wake of the scandal. She released a statement saying “I am truly sorry for the suffering caused to the 39 subpostmasters as a result of their convictions which were overturned last week.” Well Paula, this is quite frankly not good enough. There was clear evidence that the computer system provided by Fujitsu was filled with bugs from the outset in 1999. She decided to ignore these bugs and instead push the blame on to loyal and hardworking staff who then faced criminal convictions. CLICK HERE: Save ££££ on your bills with A Spokesman Said| Compare & Save Now Paula Vennells walked away with £4.9 million in pay and bonuses whilst she decided to pursue 550 postmasters through the civil courts to get back money she claimed was stolen. She even hired and fired a team of forensic accountants who pointed the finger at the faulty Horizon software. There was a failure to accept the real issue behind the seemingly missing funds by the Post Office, instead choosing to go on a bizarre witch hunt against staff and ruin their lives. CLICK HERE: You could save £££ on your household bills | Search A Spokesman Said for the best deals

In relation to Mrs Vennells it gives us a worry about our own NHS as she was deemed a ‘fit and proper person’ by NHS improvement when appointed as chairman of Imperial College NHS Trust. This is a person who promoted going after her own innocent staff for criminal convictions when ignoring real evidence, not exactly fit or proper in my opinion. She was also ordained as a priest and has been forced to step down from this role, she claims to be sorry now but where was her moral compass when the IT evidence was staring her in the face and she ignored it. I hope the wronged former Post Office employees continue to push back. It is a great shame to see a British institution in the Post Office have its reputation dragged through the mud but they must step up and do what is right for the innocent lives they have ruined. E.On leave customers in financial trouble on Christmas Day after unexpectedly taking payments4/23/2021 This is a truly disgusting story. Energy giant E.On has been reprimanded by Ofgem for charging customers earlier than agreed during the Christmas period. They took money from consumers on 24th December rather than in January when the direct debits had previously been arranged for. We all know how hard this year has been for everyone, with jobs being lost and nationwide lockdowns. Energy use has been on the up and filling the coffers of the big energy companies. CLICK HERE: Compare and save on your energy bills | GET QUOTES NOW 1.6 million E.On customers had money taken from them for an energy bill earlier than expected. This caused them great difficulty over the Christmas period with many saying how they ended up being overdrawn in their bank accounts. A horrible position to be in at Christmas. With the tough year people have had they would consider Christmas a ray of light and a time to enjoy with family, well E.On had other ideas. They left customers in a terrible position and have rightly been punished. E.On will pay £55,000 to customers who were charged early and will also contribute £627,312 to Ofgem’s energy redress fund which as well as helping E.On customers will support any consumers who are in vulnerable situations.

CLICK HERE: Save up to £497 on your energy bills | GET QUOTES NOW The regulator said “Ofgem considers that E.On failed to conduct the appropriate checks to ensure that this would not lead to any unintended consequences for customers.” My advice to E.On customers would be to seek a new energy provider. Do not let this callous company who would happily put families through a tough Christmas have any more of your money. There are many options on the energy market to save money, I urge you to do so here on A Spokesman Said. As if things weren’t bad enough with Covid and lockdowns now we are feeling the affects of prices rising across the board for consumers. People are flocking to the pubs with the lockdown restrictions easing and are finding that the prices have gone up around 10% in some pubs for a pint of draught lager. One brewery Star Pubs and Bars who are owned by Heineken UK have suggested that customers will not notice the price increases because most of them are paying by card. This particular case is an insult to the intelligence of customers from a brewery that lost over £176 million in 2020 but points to a wider problem that we are all beginning to face. CLICK HERE: You could save £££ on your household bills | Search A Spokesman Said for the best deals As reported previously by A Spokesman Said there have been price hikes in many other areas such as a car wash previously costing £20 going up to £25. Many people responded on social media to this saying some of their experiences of post lockdown price jumps. These included the price of barbers going up, nail salons charging more and even some customers noticed how supermarkets are offering fewer buy one get one free deals than they did in the past. We all understand that businesses have struggled during Covid and there is a real appetite to support them from customers who are eager to get back out shopping as lockdown ends. People themselves have also struggled and will not accept these increases in the long term, it is understandable for businesses to try and recoup some lockdown losses in the short term but this cannot continue in the future for consumers. Make sure to always shop around as you spend your money after lockdown.

CLICK HERE: Save ££££ on your bills with A Spokesman Said| Compare & Save Now Finally there is some good news for consumers, thanks to A Spokesman Said and other comparison websites the price of car insurance has seen its biggest drop for six years. According to confused.com the average cost of car insurance has fallen by £87 in the last twelve months. So at last there is some benefit from Covid, with most of us stuck at home under the lockdown house arrest it has meant there are far fewer traffic collisions. The data has shown that motorists will now spend £538 on average per year. CLICK HERE: Save ££££ on your car insurance | GET A QUOTE NOW There were 2.1 million car insurance claims last year which is down 19% on the previous year. The insurance providers are paying out a lot less so should pass some of this saving onto the customer. However, the Association of British Insurance said there were other costs that insurers had faced when supporting customers. The data however is alarming for those customers who decide to renew with the same insurer rather than going to a price comparison site. Car insurance renewals have gone up by an average of £45 per year. The data is from a wide reaching study by confused.com in conjunction with insurance broker Willis Towers Watson and has tracked 6 million insurance quotes during the first quarter of 2021. Customers cannot allow these companies to take more money, do yourself a favour and shop around for car insurance on A Spokesman Said.

CLICK HERE: Save ££££ on your car insurance | GET A QUOTE NOW The Head of Money at Which? said "The reduction in premiums is clearly a reflection in quite a radical change in driver behaviour, and people being on the road less as a result of the pandemic, but in order for consumers to get the best deal on their car insurance, they should spend time on price comparison sites.” We agree. Get onto A Spokesman Said and save yourself bundles on car insurance. CLICK HERE: Save ££££ on your car insurance | GET A QUOTE NOW I’m struggling to see what British Gas engineers are moaning about. They have been on favourable terms for the last 35 years. British Gas engineers earn £40k per year which is over £9k more than the average UK wage, to justify these wages the engineers need to improve their productivity. Centrica, the owners of British Gas lost £362 million last year. How can staff justify these lofty wages when British Gas are losing so much money? CLICK HERE: Save up to £497 on your energy bills | GET QUOTES NOW Centrica have asked staff to accept these reasonable changes of which 98% have consented to do so. Centrica has also said to us at A Spokesman Said “We have not cut base pay or changed our generous final salary pensions. Our gas service engineers remain some of the best paid in the sector, earning £40,000 a year minimum. While change is difficult, reversing our decline which has seen us lose over three million customers, cut over 15,000 jobs and seen profits halved over the last 10 years is necessary. The changes will also unlock our ability to grow jobs and hire 1000 green apprentices over the next two years.’’ There are many engineers who work 40 hours a week, which I must add is a standard working week so it beggars belief why British Gas engineers think they should be any different and stay at their 37 hours per week. British Gas will also be paying the additional 3 hours work for 2 years after which they will continue to pay this as long a staff reach a “reasonable and achievable minimum productivity target.” This equates to £2,540 per year, a very fair deal it seems to me.

CLICK HERE: You could save £££ on your household bills | Search A Spokesman Said for the best deals What this seems to come down to is that British Gas staff want a company losing a lot of money to keep backing their staffs inflated wages. When a company is losing out they have to cut back and unfortunately losing staff is a consequence. There is clearly an issue with engineer productivity so I welcome any attempt from British Gas to try and increase it. You won’t hear many easier ways to make £6,000 than how part-time gym employee Charlotte Newby came into her windfall. She claimed for a sexual harassment payout after hearing her male colleague David Saunders boast about his sex life saying this left her feeling ‘uncomfortable’. The court ruled in her favour saying that he sexually harassed her and ordered the gym in Ipswich called Functional Training Company to pay out £6,000. CLICK HERE: Save ££££ on your bills with A Spokesman Said| Compare & Save Now Mr Saunders was a commercial director at the gym so in a position of authority over Charlotte Newby who was hired on a part time basis to work 20 hours per week on front of house duties. This makes his remarks even more astonishing as it is alleged he said in a conversation with Miss Newby and two other male colleagues that 'I used to get loads of women when I was younger before I met Katy and you wouldn't believe what I used to do with them, but our sex is good.’ He went on to say 'Don't you think Oliver that a woman should always swallow? Me and Katy go for it every night of the week. I wouldn't take any less.’ In the modern workplace environment this makes David Saunders words complete madness although he says he has no recollection of the conversation. Charlotte Newby was fired from the gym before taking her harassment claim to the tribunal. She claimed that her dismissal was unfair but the tribunal ruled in the companies favour that she was only let go due to performance related issues. Mr Saunders was rightly fired for his part in the harassment case.

CLICK HERE: Save ££££ on your bills with A Spokesman Said| Compare & Save Now Gyms themselves have lots of issues with sexual harassment as women often complain of the misogynistic environment. In a 2017 article in Women’s Health magazine about sexual harassment in gyms a 33 year old woman said of her work outs in a North London gym ‘I noticed that one of the trainers would sexualise the movements that he was asking us to do and provide corrections in a similar manner,’ She went onto say ‘He’d correct deadlifts with directions to “bend over like you were taking it from behind”.’ This is just one example of many that gyms can be hotbeds of sexual harassment. Maybe we shouldn’t be so shocked at the behaviour of David Saunders in 2018 when instructors are doing the very same things. As of April 1 your energy bills went up by around 10%. The reason? The regulator Ofgem lifted the price cap which was imposed when Covid struck last March. If you shop around, and I suggest you come to A Spokesman Said, you can save back some of the money the big energy firms are trying to take from you.

The reality is that the days of cheap energy are over so you will have to be cute to make sure you are not overpaying. We are here to help. If you’re happy, we are happy. CLICK HERE: Save up to £497 on your energy bills | GET QUOTES NOW |

�

Previous articles |

Please note that some of the links on A Spokesman Said are affiliate links.

If you choose to purchase through these links, we may receive commission at no extra cost to you. By using these affiliate links, you are directly supporting A Spokesman Said, and helping us to provide you with free content and advice.

aspokesmansaid.com is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.

Talkco Ltd trading as A Spokesman Said is an Introducer Appointed Representative (IAR) of Seopa Ltd (FRN: 313860)

If you choose to purchase through these links, we may receive commission at no extra cost to you. By using these affiliate links, you are directly supporting A Spokesman Said, and helping us to provide you with free content and advice.

aspokesmansaid.com is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.

Talkco Ltd trading as A Spokesman Said is an Introducer Appointed Representative (IAR) of Seopa Ltd (FRN: 313860)

© Copyright 2013-2024. Talkco Ltd

Car Insurance Saving Figure

You could save up to £504*

*51% of consumers could save £504.25 on their Car Insurance. The saving was calculated by comparing the cheapest price found with the average of the next five cheapest prices quoted by insurance providers on Seopa Ltd’s insurance comparison website. This is based on representative cost savings from September 2023 data. The savings you could achieve are dependent on your individual circumstances and how you selected your current insurance

supplier.

Van Insurance Saving Figure

You could save up to £590* *51% of consumers could save £590.37 on their Van Insurance. The saving was calculated by comparing the cheapest price found with the average of the next four cheapest prices quoted by insurance providers on Seopa Ltd’s insurance comparison website. This is based on representative cost savings from August 2023. The savings you could achieve are dependent on your individual circumstances.

Home Insurance Saving Figure

You could save up to £165* *51% of consumers could save £165.27 on their Home Building & Contents Insurance. The saving was calculated by comparing the cheapest price found with the average of the next seven cheapest prices quoted by insurance providers on Seopa Ltd’s insurance comparison website. This is based on representative cost savings from September 2023. The savings you could achieve are dependent on your individual circumstances.

Motorbike Insurance Pay less than Figure

You could pay less than £195* *51% of consumers who received a quote for Motorbike Insurance through this service provided by Seopa Ltd. in August 2023 were quoted less than £194.60. The price you could achieve is dependent on your individual circumstances.

Bicycle Insurance Pay less than Figures

1) You could pay less than £36 for bicycles valued up to £1500*

*51% of customers with a bicycle valued up to £1500 who obtained a quote for Bicycle Insurance through this service provided by Seopa Ltd during September 2023 were quoted less than £35.12. Using the same calculation for bicycles valued between £1500 and £3000 gave a figure of £68.66 and for bicycles valued over £3000 gave a figure of £143.54. The quote price you could achieve is dependent on your individual circumstances.

2) You could pay less than £69 for bicycles valued between £1501 and £3000*

*51% of customers with a bicycle valued between £1500 and £3000 who obtained a quote for Bicycle Insurance through this service provided by Seopa Ltd during September 2023 were quoted less than £68.66. Using the same calculation for bicycles valued up to £1500 gave a figure of £35.12 and for bicycles valued over £3000 gave a figure of £143.54. The quote price you could achieve is dependent on your individual circumstances.

3) You could pay less than £144 for bicycles valued over £3000*

*51% of customers with a bicycle valued over £3000 who obtained a quote for Bicycle Insurance through this service provided by Seopa Ltd during September 2023 were quoted less than £143.54. Using the same calculation for bicycles valued up to £1500 gave a figure of £35.12 and for bicycles valued between £1500 and £3000 gave a figure of £68.66. The quote price you could achieve is dependent on your individual circumstances.

Pet Insurance Pay from Figures

You could pay from £2.56 per month*

*Price per month for cover based on a dog, Holly, aged 2, no known medical conditions, up-to-date vaccinations, and microchipped. Based on quote data provided by Seopa Ltd during August 2023. The quote price you could achieve is dependent on your individual

circumstances.

You could pay from £2.56 per month*

*Price per month for cover based on a cat, Rene, aged 4, no known medical conditions, neutered, up-to-date vaccinations, and microchipped. Based on quote data provided by Seopa Ltd during August 2023. The quote price you could achieve is dependent on your individual circumstances.

Breakdown Insurance Pay from Figures

You could pay from £15.49 per month*

*Based on quote data provided by Seopa Ltd during September 2023. This quote was provided to the majority of customers. The quote price you could achieve is dependent on your individual circumstances.

You could save up to £504*

*51% of consumers could save £504.25 on their Car Insurance. The saving was calculated by comparing the cheapest price found with the average of the next five cheapest prices quoted by insurance providers on Seopa Ltd’s insurance comparison website. This is based on representative cost savings from September 2023 data. The savings you could achieve are dependent on your individual circumstances and how you selected your current insurance

supplier.

Van Insurance Saving Figure

You could save up to £590* *51% of consumers could save £590.37 on their Van Insurance. The saving was calculated by comparing the cheapest price found with the average of the next four cheapest prices quoted by insurance providers on Seopa Ltd’s insurance comparison website. This is based on representative cost savings from August 2023. The savings you could achieve are dependent on your individual circumstances.

Home Insurance Saving Figure

You could save up to £165* *51% of consumers could save £165.27 on their Home Building & Contents Insurance. The saving was calculated by comparing the cheapest price found with the average of the next seven cheapest prices quoted by insurance providers on Seopa Ltd’s insurance comparison website. This is based on representative cost savings from September 2023. The savings you could achieve are dependent on your individual circumstances.

Motorbike Insurance Pay less than Figure

You could pay less than £195* *51% of consumers who received a quote for Motorbike Insurance through this service provided by Seopa Ltd. in August 2023 were quoted less than £194.60. The price you could achieve is dependent on your individual circumstances.

Bicycle Insurance Pay less than Figures

1) You could pay less than £36 for bicycles valued up to £1500*

*51% of customers with a bicycle valued up to £1500 who obtained a quote for Bicycle Insurance through this service provided by Seopa Ltd during September 2023 were quoted less than £35.12. Using the same calculation for bicycles valued between £1500 and £3000 gave a figure of £68.66 and for bicycles valued over £3000 gave a figure of £143.54. The quote price you could achieve is dependent on your individual circumstances.

2) You could pay less than £69 for bicycles valued between £1501 and £3000*

*51% of customers with a bicycle valued between £1500 and £3000 who obtained a quote for Bicycle Insurance through this service provided by Seopa Ltd during September 2023 were quoted less than £68.66. Using the same calculation for bicycles valued up to £1500 gave a figure of £35.12 and for bicycles valued over £3000 gave a figure of £143.54. The quote price you could achieve is dependent on your individual circumstances.

3) You could pay less than £144 for bicycles valued over £3000*

*51% of customers with a bicycle valued over £3000 who obtained a quote for Bicycle Insurance through this service provided by Seopa Ltd during September 2023 were quoted less than £143.54. Using the same calculation for bicycles valued up to £1500 gave a figure of £35.12 and for bicycles valued between £1500 and £3000 gave a figure of £68.66. The quote price you could achieve is dependent on your individual circumstances.

Pet Insurance Pay from Figures

You could pay from £2.56 per month*

*Price per month for cover based on a dog, Holly, aged 2, no known medical conditions, up-to-date vaccinations, and microchipped. Based on quote data provided by Seopa Ltd during August 2023. The quote price you could achieve is dependent on your individual

circumstances.

You could pay from £2.56 per month*

*Price per month for cover based on a cat, Rene, aged 4, no known medical conditions, neutered, up-to-date vaccinations, and microchipped. Based on quote data provided by Seopa Ltd during August 2023. The quote price you could achieve is dependent on your individual circumstances.

Breakdown Insurance Pay from Figures

You could pay from £15.49 per month*

*Based on quote data provided by Seopa Ltd during September 2023. This quote was provided to the majority of customers. The quote price you could achieve is dependent on your individual circumstances.

RSS Feed

RSS Feed